PUMA

Perceptual Mapping & Market Analysis

-

Puma wants to increase its market share and attract GEN Z consumers to its footwear products. The brand aims to understand how Gen Z consumers perceive Puma compared to competitors and identify opportunities for growth.

-

Perceptual mapping revealed that Puma is seen as affordable and comfortable but lacks the trend-driven appeal that younger consumers prioritize. With brands like Nike and Vans dominating the youth market, Puma struggles to differentiate itself, limiting its ability to grow beyond its current 17% market share.

-

In order for Puma to become a preferred sneaker brand among Gen Z Puma should postiton itself as durable, comfortable, and affordable—key attributes that drive sneaker preference among this demographic. Additionally, Puma should compete with Vans and Converse by reinforcing its presence in the old school, popular, and skater categories, positioning itself as both stylish and durable while maintaining its affordability.

ABOUT THE BRAND

PUMA is one of the world’s leading sports brands, blending performance with style to create footwear, apparel, and accessories that push the boundaries of sport and fashion. Founded in 1948 in Germany, PUMA has a rich legacy of innovation and athletic excellence, empowering athletes and creatives alike to be Forever Faster.

With a mission to drive sport and culture forward, PUMA partners with top athletes, designers, and cultural icons to create bold, trend-setting collections. From the track to the streets, PUMA fuses high-performance technology with cutting-edge design to inspire individuality and movement across the globe.

RESEARCH METHODOLOGY

A digital survey was conducted with 40 college students to understand their perceptions of footwear brands based on key attributes.

Demographics: Gender

Demographics: College Year

SURVEY DESIGN

Participants rated each brand on a 1 to 9 scale across various attributes.

Attributes included: comfortable, durable, affordable, high performance, athletic, bad quality, coupons, cheap, boring, tacky, irrelevant, out of style, casual, falls apart, popular, skater, old school, prestigious.

BRANDS

PERCEPTIONAL MAPPING

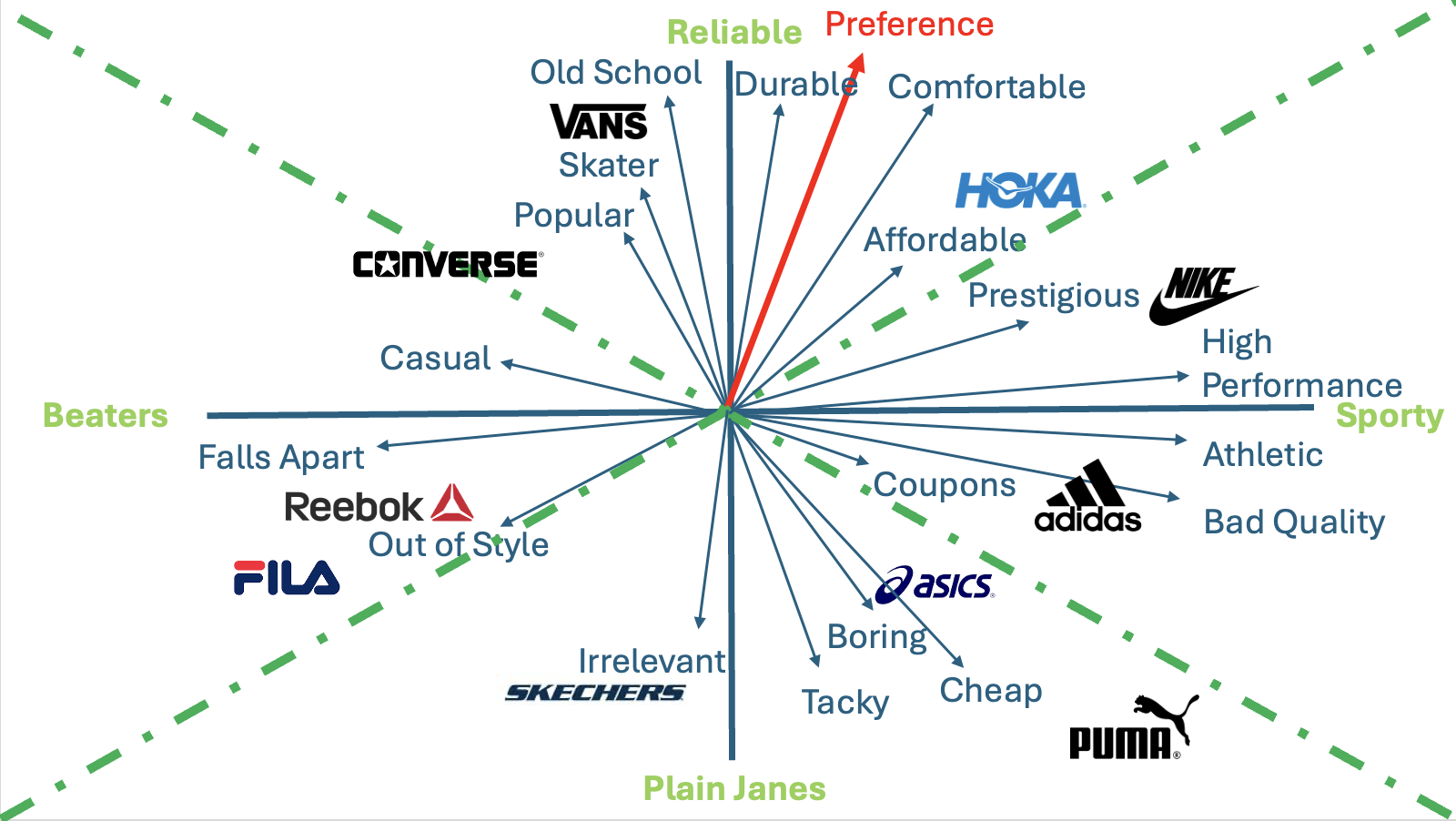

GRAND MAP

All the brands are positioned on the map based on how the target market perceives them.

The lines with the arrows are called vectors; they show us the magnitude and direction of a particular attribute.

The most important attribute is preference, as this tells us what the target market cares about the most. The primary attributes are durable, comfortable, affordable, and trendy. The secondary attributes are old school, skater, and popular.

The axes are named based solely on the attributes within each respective quadrant.

From this map, we can see that Puma is currently perceived as tacky, boring, cheap, coupons, bad quality. and athletic. Puma resides in the “Plain Janes” quadrant.

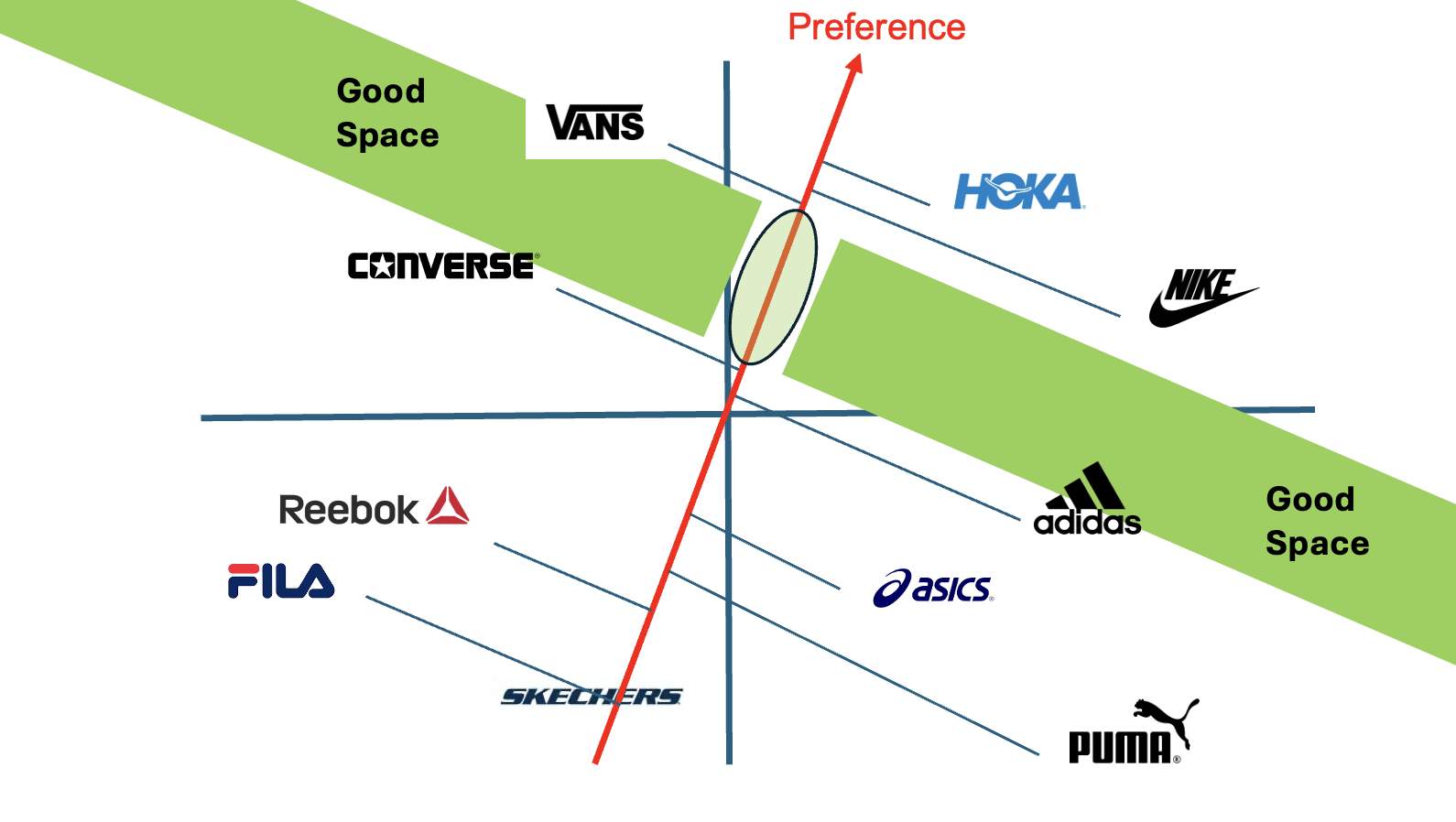

COMPETITIVE CLUSTER MAP

All the brands on this map are in competition with each other; however, brands that share the same competitive cluster are in direct competition as they compete on similar attributes.

Puma is in the “Grandma” competitive cluster with Asics and Adidas. This means that Puma’s direct competitors are Asics and Adidas.

Order of Preference

Preference is determined by where the brand’s line intersects on the preference line. In this case, the preference line is pointed up; thus, brands who intersect higher up on the preference line are considered more preferred brands by the target market. The most preferred brands are Hoka, Nike, Vans, Converse, and Adidas. The least preferred brands are Asics, Puma, Reebok, Fila, and Skechers.

The Good Space

The green rectangles represents the good space. The goal for Puma is to be in the good space when you draw a 90 degree line from the preference line.

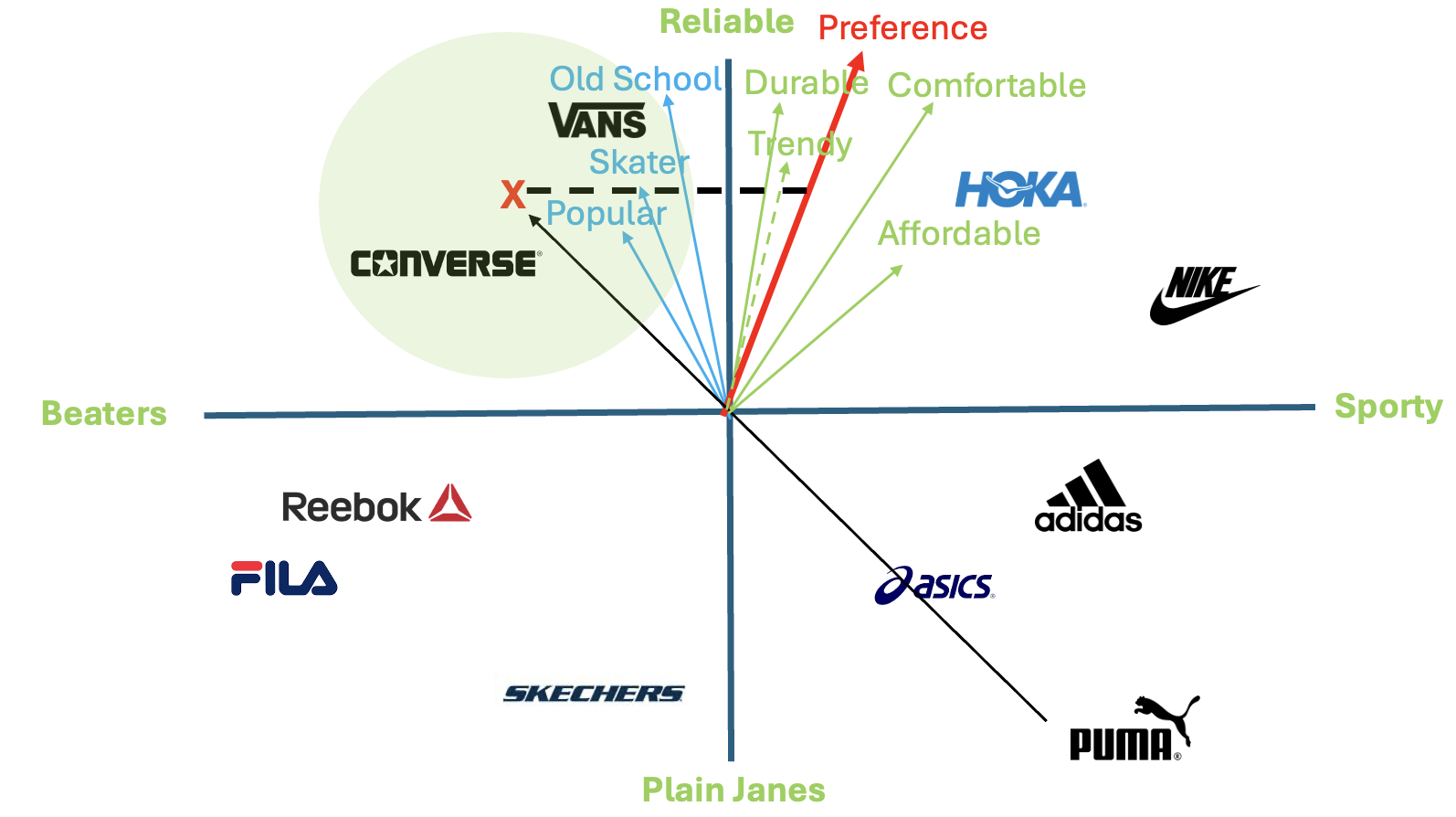

REPOSITIONING MAP

To move Puma up the preference line and become a more preferred brand among college students, Puma should highlight the primary attributes of durable, trendy, comfortable, and affordable.

Additionally, Puma should highlight the secondary attributes of old school, popular, and skater to move into the good space. In this new space, Puma will be in direct competition with Converse and Vans.

KEY TAKEAWAYS

-

In the competitive sneak market, Puma is considered a non preferred brand among Gen Z college students. Gen Z College students perceive Puma as cheap, tacky, boring, coupons, bad quality, and athletic, attributes that do not strongly align with what this demographic values in a sneaker brand.

-

Gen Z college students favor Hoka, Nike, Vans, and Converse as their top sneaker brands. They prioritize sneakers that are trendy, durable, comfortable, and affordable, while also valuing brands with a classic, popular, and skater-inspired appeal.

-

The goal is to shift Gen Z’s perception of Puma from cheap, boring, and tacky to a brand that is trendy, durable, comfortable, and affordable—key attributes that drive sneaker preference among this demographic. Additionally, Puma should compete with Vans and Converse by reinforcing its presence in the old school, popular, and skater categories, positioning itself as both stylish and durable while maintaining its affordability.